Investing is a journey that requires both knowledge and emotional resilience. Yet, many investors find themselves confused by terms that are often used interchangeably. Among the most misunderstood are the differences between volatility and risk, as well as the concepts of certainty and safety. These misunderstandings can lead to costly mistakes—reacting emotionally to short-term market swings, shunning equities in favor of seemingly “safe” investments, or failing to stay invested long enough to reap the rewards of compounding growth. The consequences of these missteps can be significant, impacting not just short-term returns but an investor’s ability to achieve long-term financial security.

At Mercer Partners, we believe that gaining a firm grasp of these key principles isn’t just about investment literacy—it’s about empowering investors to make better decisions that lead to real wealth accumulation. By unpacking these ideas, investors can develop the confidence and discipline needed to weather market fluctuations, stay committed to their financial plans, and ultimately safeguard the future they envision.

Volatility vs. Risk: Understanding the True Threat to Wealth

Nick Murray, a well-respected voice in financial planning and one of my favorite finance authors, often highlights the fundamental misunderstanding between volatility and risk. Volatility refers to the short-term price fluctuations of an investment. The stock market, for example, experiences regular ups and downs, sometimes these ups and downs can be rather dramatic. However, these fluctuations do not necessarily equate to financial loss. Rather, they are an inherent part of market activity and should not be confused with “risk”.

Risk, on the other hand, is the potential for a permanent loss of capital. True investment risk is not market dips but rather actions such as selling at the wrong time, failing to stay invested, or lacking a well-diversified portfolio. Murray further argues that “real” risk is not achieving one’s financial goals—such as to accumulating enough wealth to retire comfortably, or failing to educate your loves ones, or even running out of money before you pass away – these are the risks you should be protecting against because they have real life implications. Investors who confuse volatility with risk often make emotional decisions that harm their long-term financial well-being, such as panic-selling or trying to time the markets.

To illustrate: If an investor holds a well-diversified portfolio and the market drops by 20%, their portfolio’s value has temporarily declined—but that loss is not realized unless they sell. If they remain patient and invested, history suggests that markets tend to recover and grow over time. The real risk is not the temporary decline, but the failure to participate in the market’s eventual recovery.

At Mercer Partners, we often say, “short-term volatility is the price you pay for long-term outperformance.” While stocks are highly volatile in the short term, they are actually not very “risky” at all when viewed through the proper long-term lens. In fact, equities provide the highest probability of achieving long-term wealth goals and outpacing inflation. Over time, stocks have consistently demonstrated their ability to generate real, inflation-adjusted returns that preserve and grow purchasing power. By contrast, so-called “safe” assets such as bonds or cash equivalents may offer stability in the short run but fail to protect against inflation, eroding real wealth over time (more on this later). The key is recognizing that short-term discomfort is a necessary trade-off for long-term prosperity.

Certainty vs. Safety: Are They the Same?

Another misconception in investing is the notion that certainty equates to safety. Investors often crave certainty, seeking guarantees that their money will be safe and grow predictably. This is why some gravitate toward low-risk assets like bonds or cash equivalents, believing these provide “safety.” However, this perception can be misleading.

Nick Murray makes a crucial distinction between certainty and safety: certainty is an illusion, while true safety comes from long-term equity investing. Fixed-income investments, such as bonds and CDs, may seem safe because they provide predictable returns, but they carry their own risk—specifically, the erosion of purchasing power due to inflation.

Stocks, in contrast, are the safest investment over the long term. While they are certainly not the most “certain”—as their short-term movements can be unpredictable—they provide the highest degree of safety when it comes to growing wealth in real terms. Bonds, on the other hand, may seem certain because they provide fixed returns, but they are not truly safe. How can a fixed-income investment be considered safe when the prices of goods and services are rising year after year? Locking in a fixed-rate bond may provide nominal stability, but in real terms, it exposes investors to the very real danger of declining purchasing power.

Consider an investor who places all their assets in cash or ultra-conservative investments. While this might feel “safe” because the principal appears stable, they are actually exposing themselves to a different type of risk—the risk that their purchasing power will diminish over time. Historically, equities have provided the best chance of outpacing inflation and preserving real wealth. Safety, in the true sense, comes from investing in a way that allows money to grow and sustain purchasing power across decades.

Why Investors Struggle with These Concepts

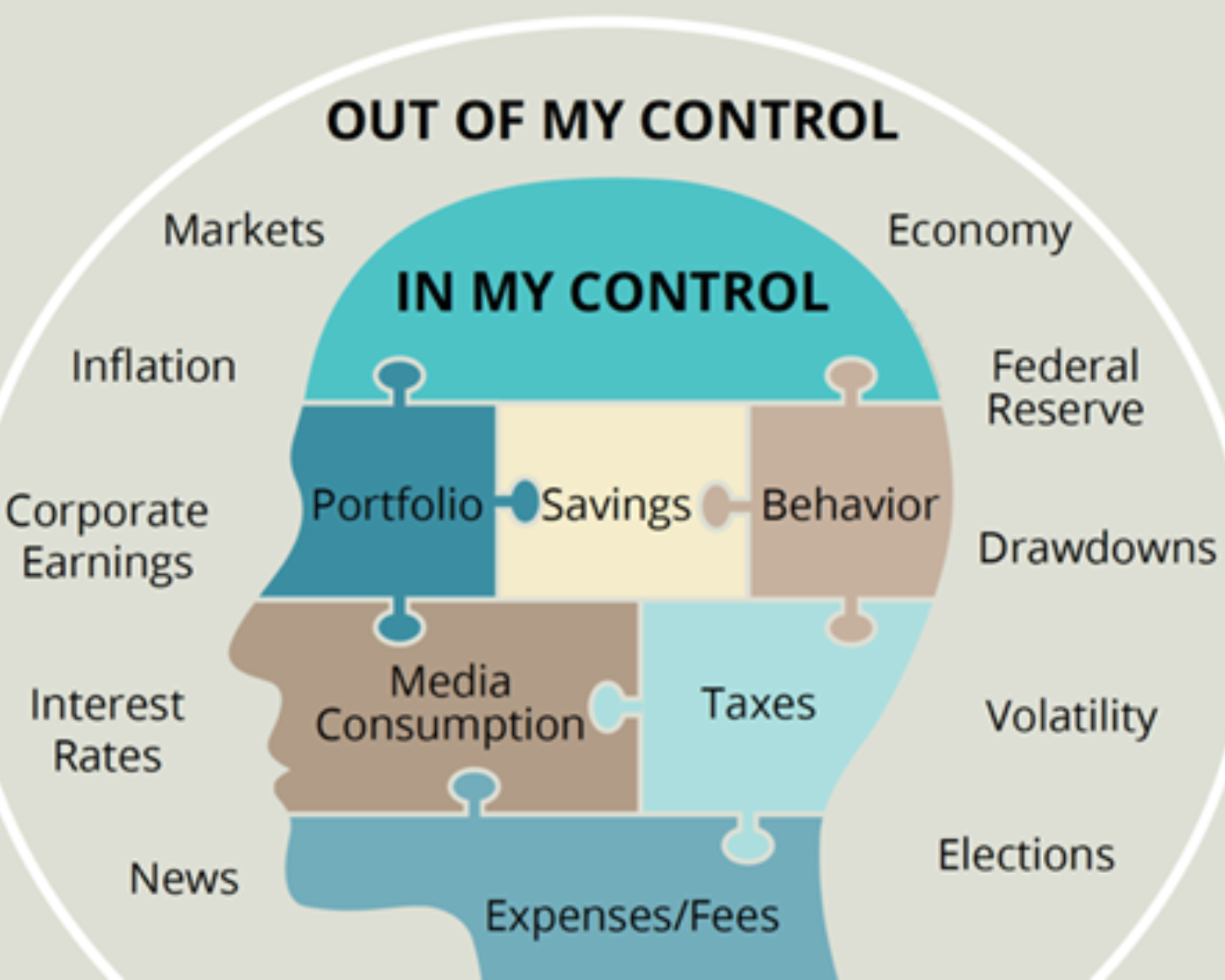

Behavioral finance tells us that investors are wired to avoid loss, which is why volatility feels like risk and why certainty feels like safety. However, allowing these biases to dictate investment decisions can lead to suboptimal outcomes. The fear of volatility leads many to flee equities during downturns, while the desire for certainty can cause them to invest too conservatively, ultimately failing to achieve their financial goals.

The proper approach to building a sound investment strategy requires following a specific sequence: Goals, Plan, Portfolio—always in that order.

- Goals: Before making any investment decisions, investors must clearly define their financial objectives. Are they saving for retirement, funding a child’s education, or ensuring a lasting legacy? Goals provide the foundation for every investment decision.

- Plan: Once goals are established, a thoughtful financial plan acts as the framework that supports success. This plan accounts for risk tolerance, time horizon, and cash flow needs, ensuring alignment with long-term objectives.

- Portfolio: Only after setting goals and crafting a plan should investors construct a portfolio. The portfolio is simply the vehicle that drives the plan forward designed to provide the necessary growth and income to fulfill financial goals.

A helpful analogy is to think of building a car. The financial plan is the chassis—the structural foundation that holds everything together. The portfolio is the engine—the component that powers the journey forward. A well-built investment strategy finds harmony between these two elements. If an investor builds a plan with too weak an engine (an overly conservative portfolio), they may not have enough power to reach their goals.

Conversely, if they build a powerful engine (an aggressive portfolio) but lack a solid chassis (a sound plan), they may be unable to handle market volatility effectively. True success comes from balancing the structure and the power to create a smooth, enduring journey toward financial independence.

Strategies to Overcome These Misconceptions

Investors who want to succeed must embrace certain key strategies:

- Understand Market Cycles: Accept that volatility is normal and does not equate to real loss unless acted upon poorly.

- Stay Invested: History shows that missing just a few of the best market days can significantly reduce long-term returns.

- Diversify Thoughtfully: A well-structured portfolio considers both short-term cash needs and long-term growth potential.

- Reframe Risk: Recognize that the real risk is not market volatility but failing to stay invested long enough to benefit from compounding growth.

- Work with an Advisor: A knowledgeable financial advisor can provide perspective, helping investors navigate emotions and stay committed to their plan.

Investing with Confidence

At Mercer Partners, we believe that successful investing is not about avoiding market swings but about maintaining the discipline to stay invested. The ability to distinguish between volatility and risk, as well as certainty and safety, is crucial for building wealth and achieving financial independence. As Nick Murray emphasizes, wealth is created by staying the course through all market conditions, not by attempting to avoid short-term discomfort. By adopting these principles and deploying our proprietary “Mercer 360°” wealth management process, our firm is well positioned to help our clients navigate uncertainty with confidence.

Through our disciplined approach—starting with goals, then crafting a thoughtful plan, and finally building a well-structured portfolio—we empower investors to stay the course and achieve long-term success. At Mercer Partners, we’re committed to guiding our clients with wisdom, patience, and a steady focus on what truly matters: pursuing a brighter financial future.

Best,

Nick