Spring is here, and with it comes the start of the little league baseball season. My five-year-old son is taking the field for another season, and if there’s one lesson I keep reinforcing with him, it’s this: keep your eye on the ball. It’s a simple but powerful truth—whether you’re standing in the batter’s box or investing for the long term, focus is everything.

In the world of investing, there’s no shortage of distractions. The financial news cycle is relentless, churning out headlines that can send even the most seasoned investors into a tailspin. Right now, markets are being rattled by a confluence of concerns—tariff tensions, recession concerns, and geopolitical turmoil. It’s easy to get caught up in the noise, but just like in baseball, success comes from tuning out the distractions and focusing on what truly matters.

Tariff Tensions

The global trade landscape is once again in flux as new tariff policies threaten to disrupt supply chains and corporate earnings. The latest round of proposed tariffs has heightened uncertainty, leading to increased volatility in equities, particularly in industries heavily reliant on international trade. While some view these measures as a negotiating tactic, markets are reacting with caution, as prolonged trade disputes can weigh on economic growth and investor confidence.

The Fed and Economic Slowdown

Hopes for imminent interest rate cuts have been tempered by signs of economic deceleration. Recent data suggest that while inflation is gradually cooling, the Federal Reserve is hesitant to cut rates too soon for fear of reigniting price pressures. At the same time, economic indicators—such as a slowdown in consumer spending and a cooling labor market—suggest that growth may be moderating. The Fed’s cautious stance reflects the delicate balancing act between supporting growth and maintaining financial stability.

Geopolitical Tensions

Markets remain on edge as geopolitical uncertainty looms large. Conflicts in key regions, shifting alliances, and energy market disruptions are fueling concerns about broader economic implications. These uncertainties create market fluctuations, but history shows that disciplined investors who focus on fundamentals rather than fear-driven headlines are more likely to achieve long-term success. Just as every at-bat won’t result in a hit, not every market day will end in the green. This year, we’ve already seen dramatic swings—stocks rallying on hopes of rate cuts, only to pull back when the data suggests the Federal Reserve may keep rates higher for longer. It’s a classic case of the market overreacting to short-term developments rather than focusing on the fundamentals.

A Game Plan for Growth

If my son were to step up to the plate worrying about every possible outcome—striking out, hitting a foul ball, getting tagged out—he’d never take a confident swing. The same goes for investors. Those who react to every market dip or media-driven panic often make costly mistakes. The most successful investors, like the best hitters, trust their preparation and play the long game. Here’s what keeping your eye on the ball means for your portfolio:

- Stick to Your Plan: Your financial plan is your playbook. Don’t abandon it just because the financial markets are throwing a few curveballs.

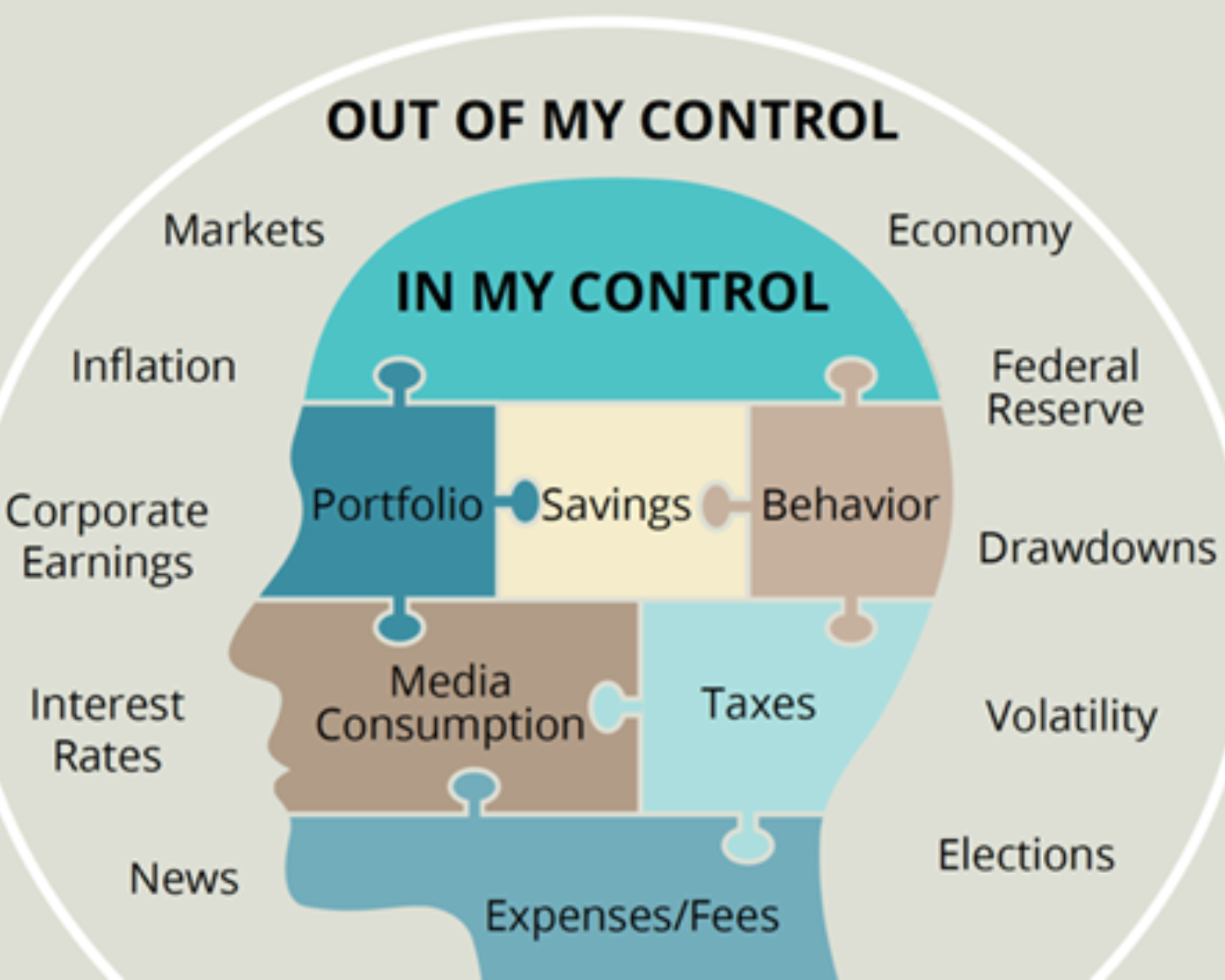

- Control What You Can: You can’t predict the Fed’s next move or the outcome of geopolitical events, but you can control your spending habits, your asset allocation, and your discipline in staying invested.

- Don’t Chase the Headlines: Much like a batter who swings at wild pitches, investors who react to every market headline often find themselves off balance. The best opportunities come to those who wait for the right pitch—or, in investing terms, those who remain patient and let compounding work in their favor.

Stepping Up to the Plate

This season, I’ll be cheering on my son as he continues to learn the basic fundamentals of baseball—patience, focus, and discipline. At the same time, I’ll be reminding my clients of the same virtues in investing. Markets will have their ups and downs, but those who stay focused on their long-term goals are the ones who ultimately win the game.

So, as we move through the months ahead, let’s keep our eye on the ball, ignore the noise, and trust the markets. The home runs in investing don’t come from chasing the latest trend but from staying the course, one disciplined swing at a time.

Best,

Nick