Investing in the capital markets remains one of the most efficient and effortless ways for everyday people to build meaningful, long-term wealth. Outside of starting your own business (which requires a lot of effort), no other strategy offers a comparable opportunity to grow your money over time. Yet, achieving success as an investor requires more than simply participating in the market—it demands a deep understanding and disciplined application of key investment principles. In this essay, I will share my four cornerstone “rules” that I believe every investor should embrace: 1) Be an Owner; 2) Stay Diversified; 3) Don’t Try to Time the Market; and 4) Avoid Panic Selling.

Together, these four rules will account for upwards of 90% of your lifetime investment returns (in my opinion). In other words, mastering these principles is critical to fully maximizing your true wealth-building potential. Failing to follow them regularly will more than likely result in underperformance, hindering your ability to achieve financial independence. While these rules appear simple—and they are, by design—applying them consistently is anything but easy.

The reality is that powerful, counterproductive forces are constantly challenging your resolve. Chief among them is the mainstream financial media, whose primary objective is selling advertising, not fostering sustainable wealth-building habits. Tuning out market noise and remaining focused on what truly matters requires discipline and clarity of purpose.

These principles form the foundation of our philosophy at Mercer Partners, an independent wealth management firm committed to helping clients pursue lasting financial prosperity as they approach or enjoy retirement. We guide our clients towards making smart decisions with their hard-earned money, ensuring their investments are aligned with their long-term goals.

1. Be an Owner of Businesses, not a Lender

This principle encourages thinking like a business owner rather than a lender. When you invest in stocks, you buy a share of a company’s future earnings and growth potential, whereas lending through bonds offers fixed returns with limited upside. Consider this question: would you rather own a piece of Google or simply lend your money to Google? Most would prefer ownership—and for good reason. Stocks represent a claim on a company’s profits and success, making them the superior wealth-building investment.

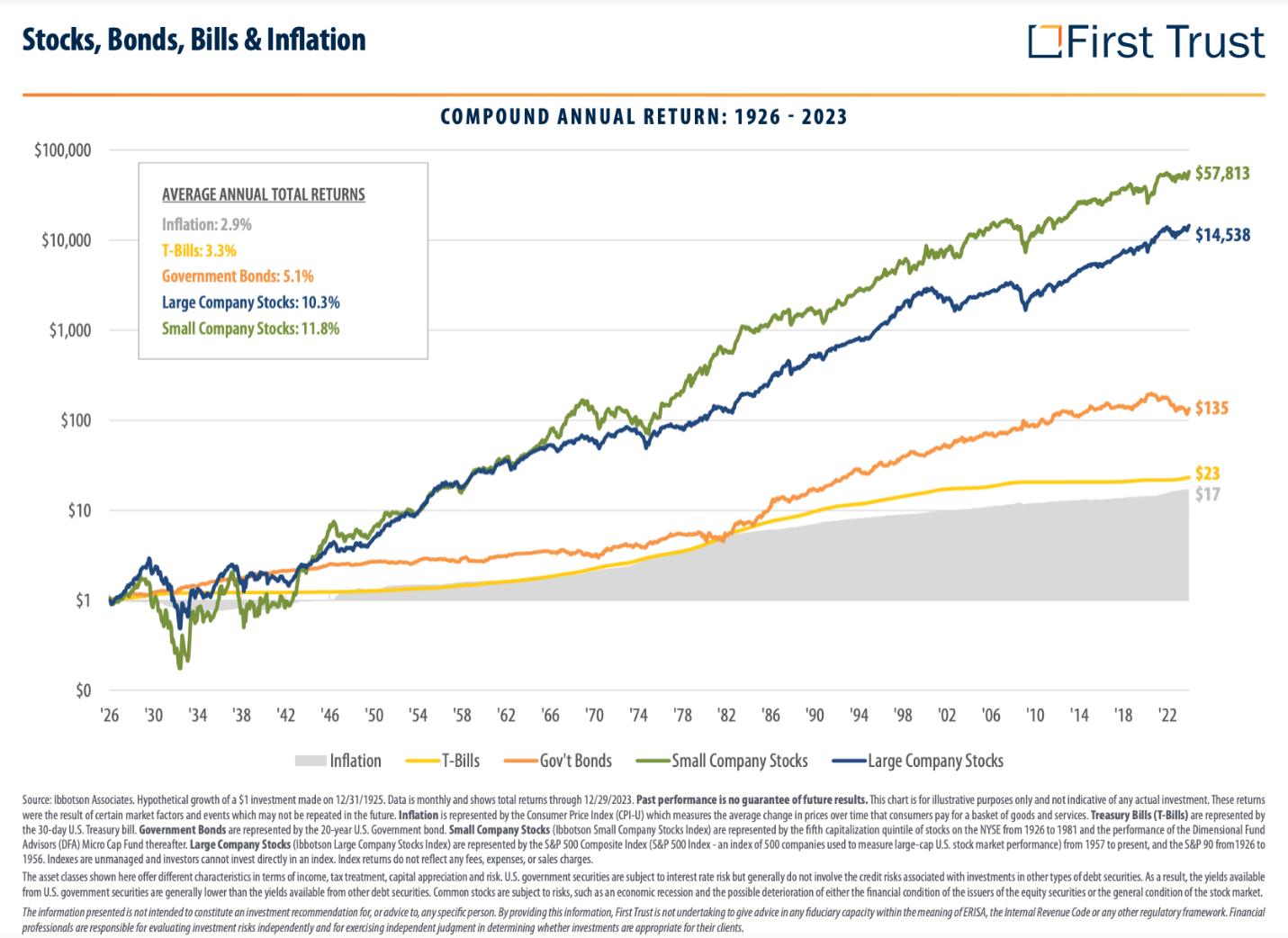

Equities have historically delivered significantly better long-term performance than bonds, driven by capital appreciation and the powerful effect of compounding—where reinvested earnings and dividends generate even more returns. According to data from Ibbotson Associates, the S&P 500 Index has delivered an average annual return of just over 10% over the last century. In contrast, the most comparable bond index has returned approximately 5% annually—less than half the return of equities. When accounting for inflation, which has averaged around 3% per year over the same period, the inflation-adjusted (or real return) returns of stocks have outpaced bonds by more than three times.

This stark performance gap underscores why equities are considered the superior wealth-building vehicle. Historically, mainstream equities have been an exceptionally effective hedge against inflation, preserving and growing purchasing power over time. Bonds, on the other hand, offer fixed returns that are often eroded by rising prices, making them a far less effective tool for long-term capital appreciation and building significant wealth.

Market conditions and economic cycles will always fluctuate. Simultaneously, great companies with smart leadership teams will continue to innovate, create value, and drive global economic growth, reinforcing our strong preference for owning great businesses rather than lending to them. By investing in equities, you participate in the long-term success of human ingenuity and progress—the true engines of sustainable wealth creation.

2. Broadly Diversify Your Investment Portfolio

Diversification is often said to be the only free lunch in investing—and for good reason. By spreading investments across different market sectors, industry groups, and geographic regions, investors reduce risk and minimize the impact of poor performance in any single area of the market. The beauty of a well-diversified portfolio lies in its ability to capture the broad market’s returns—an especially compelling benefit, considering that, as I noted previously, the stock market has historically offered substantial growth over time.

Imagine an investor who concentrates solely on technology stocks. During a tech boom, this strategy may lead to impressive gains, but when the sector experiences a downturn (which it inevitably will), the same portfolio could suffer substantial losses. Diversifying into other sectors such as consumer staples, healthcare, financials, industrials, among others helps smooth performance, as losses in one sector can be offset by gains in others.

Geographic diversification is equally critical. Economic cycles, political environments, and market dynamics differ across regions. International investments not only reduce risk but also offer access to growth opportunities in emerging markets. While developed markets like the United States and Europe provide stability, regions such as Asia and Latin America often present higher growth potential. At Mercer Partners, we definitely like to tilt (or overweight) our portfolios toward “The Great Companies of America,” but we do believe in power of global diversification—because some of the world’s most innovative and profitable companies are found overseas.

A well-diversified portfolio balances risk and opportunity, delivering smoother and more consistent returns over the long term. While it’s tempting to concentrate on top-performing giants like Apple, Nvidia, or Google, true diversification ensures you own enough of the winners to build wealth, but not so much of any one company that your portfolio’s fate depends on it. I believe Jack Bogle, the late pioneer of passive investing, founder of Vanguard, and author of The Little Book of Common Sense Investing, captured it best when he famously said, “Don’t look for the needle in the haystack—just buy the haystack!”

We view diversification as an essential strategy to preserve wealth, purchasing power, and capture economic opportunities worldwide. A disciplined, diversified approach is one of the foundations of long-term investment success.

3. Never Try to Time the Stock Market

One of the most common and costly mistakes investors make is attempting to time the market—trying to predict when prices will rise or fall in order to outperform the broader market. Research consistently shows that market timing leads to underperformance for most investors. Even the most seasoned professional fund managers with advanced tools and vast resources often fail to beat the market by timing trades. Those same fund managers will readily admit that they typically rely on superior security selection through fundamental research to gain an edge on the market—not through market timing.

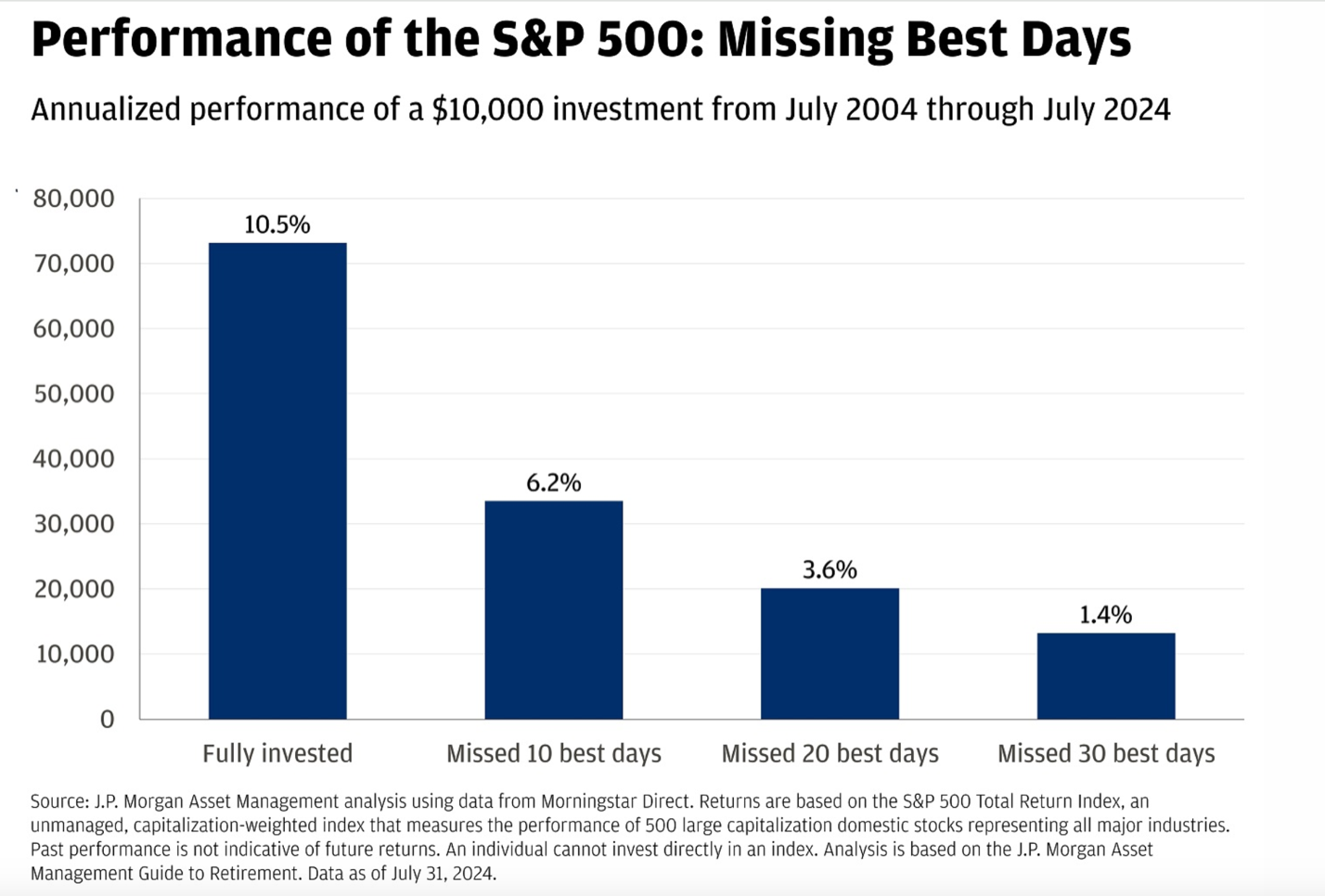

Why is timing the market so difficult? First, you have to be right twice: once when deciding to exit the market and again when determining the perfect moment to get back in. Consider this—missing either decision by even a few days can have significant consequences. Historical data demonstrates that the stock market’s biggest gains frequently occur in close proximity to its steepest declines. For example, during major downturns, fear-driven selloffs are often immediately followed by rapid recoveries. Missing just the 10 best-performing days in the market over a 20-year span can slash returns by more than half. Trying to anticipate these swings is similar to gambling, not investing, and the odds are not in your favor.

Concrete evidence further highlights the risk: According to a study by J.P. Morgan, from mid 2004 thru mid 2024, the S&P 500 generated an average annual return of 10.5%. However, investors who missed the 10 best trading days in that period saw their returns shrink to just 6.2%. Missing 20 of the top days reduced returns to a mere 3.6%. These statistics underscore how critical it is to stay invested, even during turbulent times, rather than attempting to time the market’s unpredictable movements.

Instead of chasing fleeting opportunities, adopting a strategic asset allocation aligned with your long-term financial goals is key. Regular portfolio rebalancing helps maintain this alignment without surrendering to market timing temptations. At our firm, we direct our clients to focus on evidence-based investing and to harness the power of compounding over time. Success in investing is built on time in the market, not timing the market.

4. Avoid Panic Selling During Market Drawdowns

Market volatility is inevitable, but emotional reactions to short-term declines can be wildly detrimental to long-term success. Panic selling during downturns locks in losses and prevents investors from participating in the eventual recovery. While it’s natural to feel anxious when markets are turbulent, staying invested is critical to achieving your financial goals.

Allow me to underscore the fact that equities come with short-term volatility, which can feel incredibly unsettling. But as we often remind our clients, “Short-term market swings are the price you pay for long-term outperformance.” Enduring these ups and downs allows you to benefit from the market’s historical upward trajectory.

Investors understand that market corrections and bear markets are inevitable steps along the investment journey. Time and again, markets have rewarded those who remain patient and committed to their strategy. For example, during the financial crisis of 2008–2009, many investors sold their holdings in fear as the market plummeted. Those who stayed the course, however, experienced the recovery that followed. Similarly, during the COVID-19 market crash of 2020, stocks fell by 33% in just 34 days. Despite the panic, the market rebounded fully within six months.

The key to navigating market turbulence is developing the discipline to stay calm and focused on your long-term plan. A well-constructed investment strategy aligned with your goals and risk tolerance empowers you to weather downturns confidently. History shows that markets recover, and disciplined investors who stay invested and focus on long term growth can benefit from market recovery. Remember—success in investing isn’t about avoiding market declines; it’s about enduring them with conviction.

Conclusion

Building a strong investment foundation requires understanding and applying key principles that have stood the test of time. These four rules for investing are designed to help everyday investors achieve better outcomes over the course of their lifetime. By thinking like a business owner rather than a banker, constructing a high-quality, broadly diversified portfolio, avoiding the pitfalls of market timing, and resisting the urge to panic sell during temporary market declines, investors better position themselves for long-term success.

These guidelines not only foster more stable and rewarding investment experiences but also cultivate the mindset necessary to navigate financial markets with confidence. At Mercer Partners, we are dedicated to guiding our clients toward positive financial outcomes and true financial independence. Our philosophy is rooted in the belief that disciplined, thoughtful investing—anchored by these four rules of success—is the surest path to lasting wealth and financial independence. Regardless of market conditions or economic cycles, these timeless principles provide a roadmap for sustainable wealth creation. As you pursue your financial goals, remember that faith, patience, and discipline are your greatest allies on the journey to prosperity.

Best,

Nick

Nick Enzweiler, CFP