Markets don’t move in straight lines. Even the healthiest long term uptrends experience pullbacks, corrections, and occasionally, full-blown bear markets. For investors, these periods can feel unsettling—especially when headlines scream panic and portfolio values drop. But at Mercer Partners, we believe market volatility isn’t just something to endure—it can also present valuable planning opportunities.

When markets decline, it’s a good time to pause, take stock, and focus on the things you can control. Market pullbacks are not the time to abandon your plan—they’re the time to refine it. In this article, we’ll walk through several strategies worth considering when markets retreat. Each is grounded in sound financial planning and designed to help you make progress—even when it feels like the market is pulling you backward.

- Tax Loss Harvesting: Turning Losses into Long-Term Wins

When markets dip, some investments may temporarily decline below your purchase price. While no one likes to see losses, these can actually become a powerful tax tool. Tax loss harvesting involves intentionally selling investments at a loss to offset capital gains elsewhere in your portfolio—or even to reduce up to $3,000 of ordinary income per year.

You can then reinvest the proceeds into similar (but not “substantially identical”) securities to maintain your investment exposure while locking in the tax benefit. Over time, this can meaningfully improve your after-tax returns. At Mercer Partners, we help clients harvest losses thoughtfully, always with a view toward their broader plan and future tax implications.

- Roth Conversions: A Discounted Entry into Tax-Free Growth

A market pullback can be a prime opportunity to convert pre-tax IRA assets into a Roth IRA. When the value of your portfolio has temporarily declined, converting to Roth means you’ll pay taxes on a lower amount.

Once in a Roth IRA, the assets grow tax-free, and qualified withdrawals in retirement are also tax-free. For clients who expect to be in a higher tax bracket in the future, or who want to build a more flexible, tax-diversified portfolio, Roth conversions can be a smart long-term play. When markets correct, we often revisit Roth opportunities for clients with room in their tax brackets or those facing lower-income years.

- Portfolio Upgrades: Rebalancing into Higher Quality Holdings

Down markets tend to separate the wheat from the chaff. Market downturns often expose weaker holdings—those without strong fundamentals or staying power. This is an opportune moment to upgrade your portfolio by moving out of lower-quality or speculative assets and into investments with higher potential for long-term growth. That might include companies with durable competitive advantages, strong balance sheets, and consistent cash flow—businesses built to weather cycles and thrive over time.

Rebalancing during a market downturn allows you to trim from areas that held up well and add to those that may be temporarily undervalued. It’s the ultimate “buy low, sell high” discipline—but it only works if done thoughtfully and consistently. We work closely with our clients to ensure any changes serve their plan and reflect their tolerance for risk.

- Increase Contributions While Prices Are Low

For investors still in the accumulation phase, market pullbacks offer a chance to buy more shares for the same dollar amount. Whether you’re contributing to a 401(k), IRA, brokerage account, or 529 plan, adding funds during a downturn can boost long-term returns. Think of it as buying future growth at a discount.

For retirees, it may be worth shifting how you allocate new cash or rebalancing within tax-advantaged accounts to maintain alignment with your long-term plan. The key is to keep investing consistently, even when the market feels uncertain.

- Reevaluate Your Cash and Liquidity Needs

For those nearing or in retirement, cash flow becomes a top priority. A market downturn is a good time to review your liquidity needs. Do you have enough cash or short-term fixed income to fund several years of withdrawals without tapping equities at depressed prices?

If not, it may make sense to rebalance or reposition part of the portfolio into more stable, income-generating assets. This “safety bucket” strategy can provide financial confidence and help avoid selling during downturns. At Mercer Partners, we are huge proponents of “bucketing” your assets across various investment objectives to help provide for growth, income, and liquidity.

- Review Estate Planning Documents and Gifting Opportunities

Market corrections often remind us of life’s unpredictability—making it a good time to review your estate plan. Are your wills, trusts, and powers of attorney up to date? Do your beneficiary designations still reflect your wishes?

In addition, consider strategic gifting. Depressed asset values may allow you to transfer more shares under the annual gift tax exclusion or lifetime exemption, potentially reducing your estate tax exposure while helping loved ones or philanthropic causes.

- Revisit and Reaffirm Your Plan

One of the most valuable things you can do during a market correction is simply revisit your financial plan. Are your goals still the same? Has your timeline changed? Do your income needs look different now than they did a year ago? Has your risk profile changed?

A well-crafted plan should account for downturns. But it’s always worth a fresh look—especially during periods of volatility. Market movements often reveal whether your plan is built on a solid foundation or whether adjustments are needed. At Mercer Partners, we encourage our clients to use times like these to revisit assumptions, reaffirm goals, and reinforce the confidence that comes from having a thoughtful, forward-looking plan.

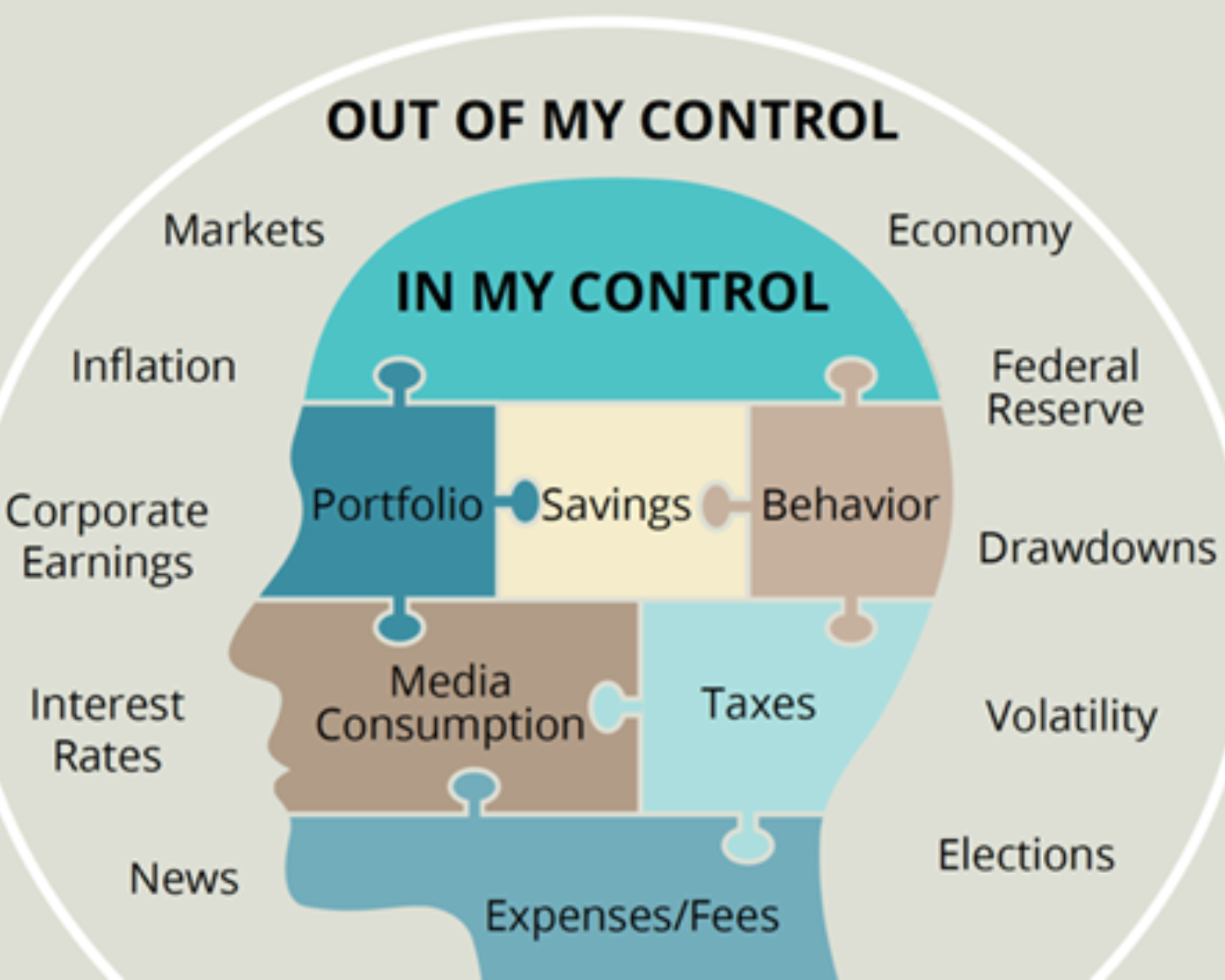

Focus on What You Can Control

Market pullbacks are a natural and expected part of the investment journey. While they may feel like setbacks in the moment, they often present some of the best opportunities to position yourself for the long-term.

At Mercer Partners, we help hard working people navigate these moments with precision and focus. Our goal is to ensure that no matter what the markets are doing, you’re making progress toward your financial goals with confidence and clarity.

The headlines may be out of your control—but your plan, your decisions, and your discipline are firmly within your grasp. And to me, that’s where the real power lies. I hope this helps!

Best,

Nick

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

No investment strategy assures a profit or protects against loss.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.

The advisors of Mercer Partners Wealth Management are registered representatives with, and securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Mariner Independent Advisors Network, a registered investment advisor. Mercer Partners Wealth Management and Mariner Independent Advisors Network are separate entities from LPL Financial.