Dear Clients & Friends,

Markets have once again found themselves in turbulent waters. Recent tariff announcements and escalating trade tensions have sparked sharp selloffs and heightened volatility across the broader market. Friday’s drop rolled into Monday with unsettling force, and the headlines are doing little to calm nerves.

This is what we call a gut check moment—when the financial news feels relentless, the red ink feels personal, and doubt starts to whisper louder than conviction. Let’s pause, breathe, and bring things into focus.

What We’re Focused On

- This is a reaction to uncertainty—not economic collapse.

Markets hate surprises. Especially geopolitical ones. But it’s important to remember: this selloff is being driven by uncertainty around trade policy, not by a breakdown in corporate earnings or a recessionary economy. The U.S. labor market remains strong. Consumer spending is steady. Many companies are still growing profits. This is not 2008. Not even close.

Historically, markets have weathered far worse. The S&P 500 has endured wars, political scandals, inflation spikes, pandemics, and yes—trade wars. And each time, it eventually found its footing and moved higher.

- Your plan already accounts for times like this.

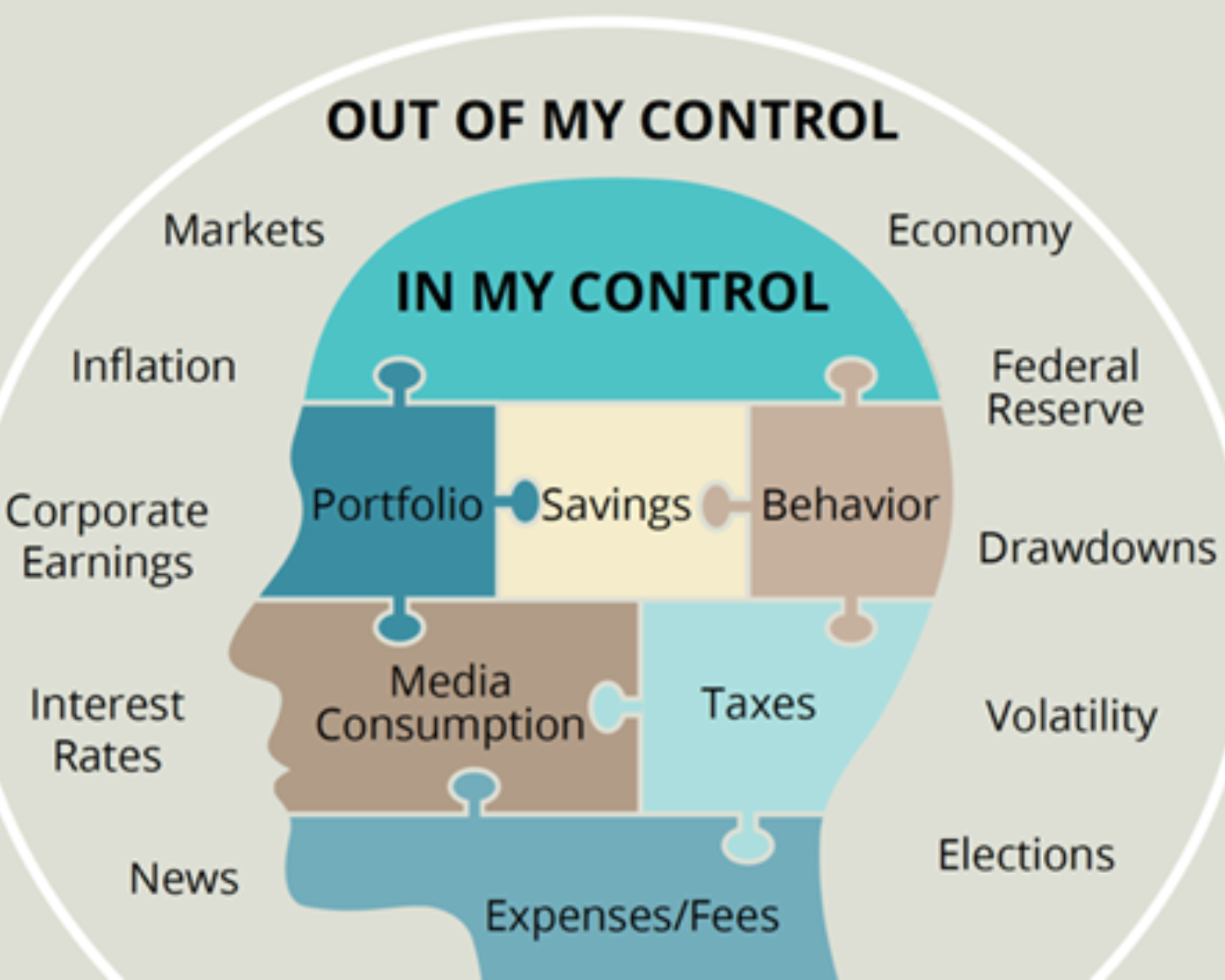

We didn’t build your plan assuming smooth sailing. We planned for storms. Volatility is not a flaw in your portfolio—it’s a feature we’ve accounted for, using thoughtful diversification and risk alignment that matches your most important life goals and investment time horizon, not today’s headlines.

- Emotional decisions are often the most expensive.

It’s tempting to want to do something—but when markets drop suddenly, the best move is often no move at all. History is clear: investors who sell during downturns frequently miss the rebound. And the rebound, when it comes, is often sudden and sharp (emphasis added).

Think back to March 2020: in just 33 days, the market fell 34%. But by August, it had recovered all its losses. Those who stayed the course were rewarded. Those who jumped ship missed one of the fastest recoveries in market history.

- Volatility creates opportunity.

Periods like this can be useful—not just stressful. We’re actively evaluating strategies like tax-loss harvesting, opportunistic rebalancing, Roth IRA conversions, and identifying entry points for long-term themes that may now be trading at attractive prices. When the markets drop, it can be an opportunity to upgrade the quality and long-term value of your portfolio. When approached strategically, turbulence can be an advantage.

What This Means for You

If you’re feeling uneasy, you’re not alone. These moments are meant to test your patience. But we built your plan for exactly this kind of environment—with the understanding that great outcomes are only possible if we’re willing to stay disciplined when it’s hardest.

This isn’t just a financial decision—it’s a test of perspective. And we’re here to walk through it with you. Please don’t hesitate to reach out. Whether it’s for reassurance, a portfolio check-in, or just to talk through what’s happening—we’re here for all of it.

Best,

Nick