Dear Clients & Friends,

As we move through February 2025, it’s important to stay grounded given the current market environment. Market volatility has ramped up—fueled by tariff developments, technological shifts, and other unpredictable factors— which can feel unsettling, especially for those nearing or entering retirement. However, by keeping a long-term focus and adhering to a disciplined strategy, you can navigate the turbulence and stay on course to meet your goals.

Tariff Trepidations

One of the most notable recent developments in the market is the reimplementation of Chinese tariffs. Last week, the U.S. imposed new tariffs on a wide range of Chinese imports, including electronics, textiles, and industrial equipment. These tariffs are expected to affect consumers directly, with the potential for higher prices on goods like smartphones, clothing, and household appliances. For investors, this adds a layer of complexity, particularly in consumer-focused industries where margins are thin. Companies that rely heavily on Chinese imports are already seeing stock price fluctuations as investors factor in the possibility of higher costs and lower demand.

On a more positive note, tariffs on imports from Canada and Mexico, which were initially set to increase, have been paused for 30 days in exchange for commitments to bolster border security. This temporary halt provides a brief window of stability, but these trade tensions remain a point of uncertainty. Retail giants like Walmart and Target may still experience pressure as their cost of goods rises, potentially leading to higher prices for consumers. On the other hand, U.S.-based manufacturers may find new opportunities in reshoring production as supply chains are forced to adjust. It’s important to remember that while tariff-driven uncertainty can cause short-term market dips, markets have historically absorbed such shocks over time. For investors, staying focused on long-term growth and not reacting impulsively to these changes is key.

Technological Shifts

In addition to tariffs, another area of intense market activity has been the technology sector, particularly around developments in artificial intelligence. Recently, the launch of DeepSeek’s new AI assistant sent shockwaves through the industry. The Chinese startup’s rapid rise in popularity has posed a challenge to established players like Microsoft, Google, and Nvidia which sent their stock prices sliding in early February. Although the underlying economic viability of DeepSeek and the cost to build the model remains highly questionable.

The AI market is currently in a state of disruption, with companies racing to dominate this evolving space. While this presents tremendous opportunities for growth, it also introduces considerable risk, as newer players may disrupt established markets or render certain technologies obsolete—and do so very quickly. For investors, this highlights the importance of staying vigilant and assessing the potential long-term value of tech stocks rather than getting swept up in the short-term enthusiasm.

Maintain Perspective

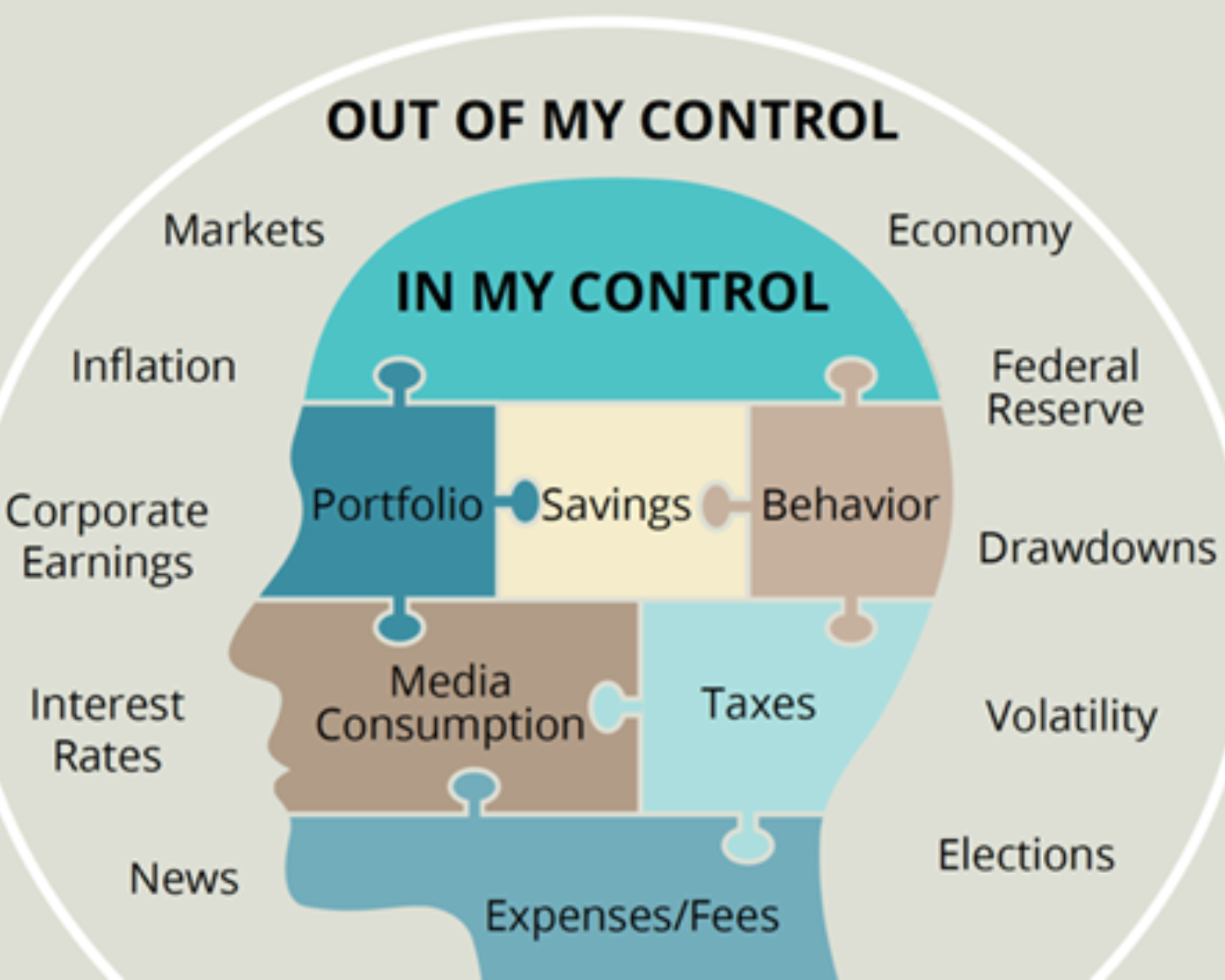

As we continue to see changes in tariffs, technological advancements, and geopolitical events, it’s clear that market volatility is likely to persist in the near term. The unpredictability of these factors underscores the importance of staying committed to a well-crafted financial plan. History has shown time and again that markets will fluctuate, but the key to successful investing is faith in your plan, patience to ride out the volatility, and discipline to stay on track.

We know that when markets become turbulent, it’s easy to feel uncertain about your investments. However, those who remain patient and disciplined through these periods are more likely to come out ahead. Trusting in your long-term strategy and focusing on your financial goals will help you stay steady and avoid making rash decisions in response to short-term swings.

Navigating Uncertainty

To effectively manage the risks associated with market uncertainty, we are currently counseling our clients to follow these three time-tested strategies:

- Diversify to Preserve: Spread your investments across different asset classes and sectors to reduce risk and increase your chances of consistent returns.

- Stay Focused on Your Plan: Trust the market. Review your plan regularly but avoid the temptation to make knee-jerk reactions to daily market movements.

- Harness Patience and Discipline: Long-term success is built on steady, consistent actions. Keep your eyes on the bigger picture, not short-term distractions.

Concluding Remarks

The current market landscape is a reminder that volatility is an inevitable part of investing. Whether it’s the impact of new tariffs or the rapidly changing technology sector, these themes create short-term uncertainties. But for long-term investors, the ability to stay calm, committed, and disciplined is what ultimately drives success. By trusting in your plan and summoning the all-so-important traits of faith, patience, and discipline, you position yourself for financial success—no matter what the market throws your way.

As always, we are here to guide and support you along your financial journey. Should you have any questions or wish to discuss your investment strategy in more detail, please do not hesitate to reach out – that’s precisely what we’re here for.

Best,

Nick