Planning for retirement is more than just saving—it’s about creating a sustainable strategy to ensure your assets support your lifestyle throughout your golden years. At Mercer Partners Wealth Management, our Mercer 360° Process provides a comprehensive approach, tailored to each client’s unique financial journey. From retirement planning to investment management and beyond, we’re here to guide you every step of the way.

The Mercer 360° Process: Tailored Retirement Income Solutions

As your life evolves, so do the complexities of your financial needs. Our three-step Mercer 360° Process ensures that your retirement income strategy remains aligned with your goals:

- ASSESS – We begin by understanding your current financial situation, goals, and values. This comprehensive assessment allows us to craft a strategy that reflects your vision for retirement—whether that’s traveling the world, supporting family, or leaving a legacy.

- BUILD – With your goals clarified, we design a holistic, tax-efficient plan that considers every aspect of your financial life. From optimizing withdrawal strategies to integrating investment and tax planning, our approach ensures your retirement savings are positioned for long-term success.

- MANAGE – Life doesn’t stand still, and neither should your financial plan. We provide ongoing monitoring and adjustments, helping you navigate market fluctuations and life transitions with confidence and clarity.

Crafting a Sustainable Withdrawal Strategy

One critical component of retirement income planning is determining how to draw from your savings sustainably. While the “4% rule”—withdrawing 4% of your savings annually, adjusted for inflation—is a common guideline, it’s not a one-size-fits-all solution.

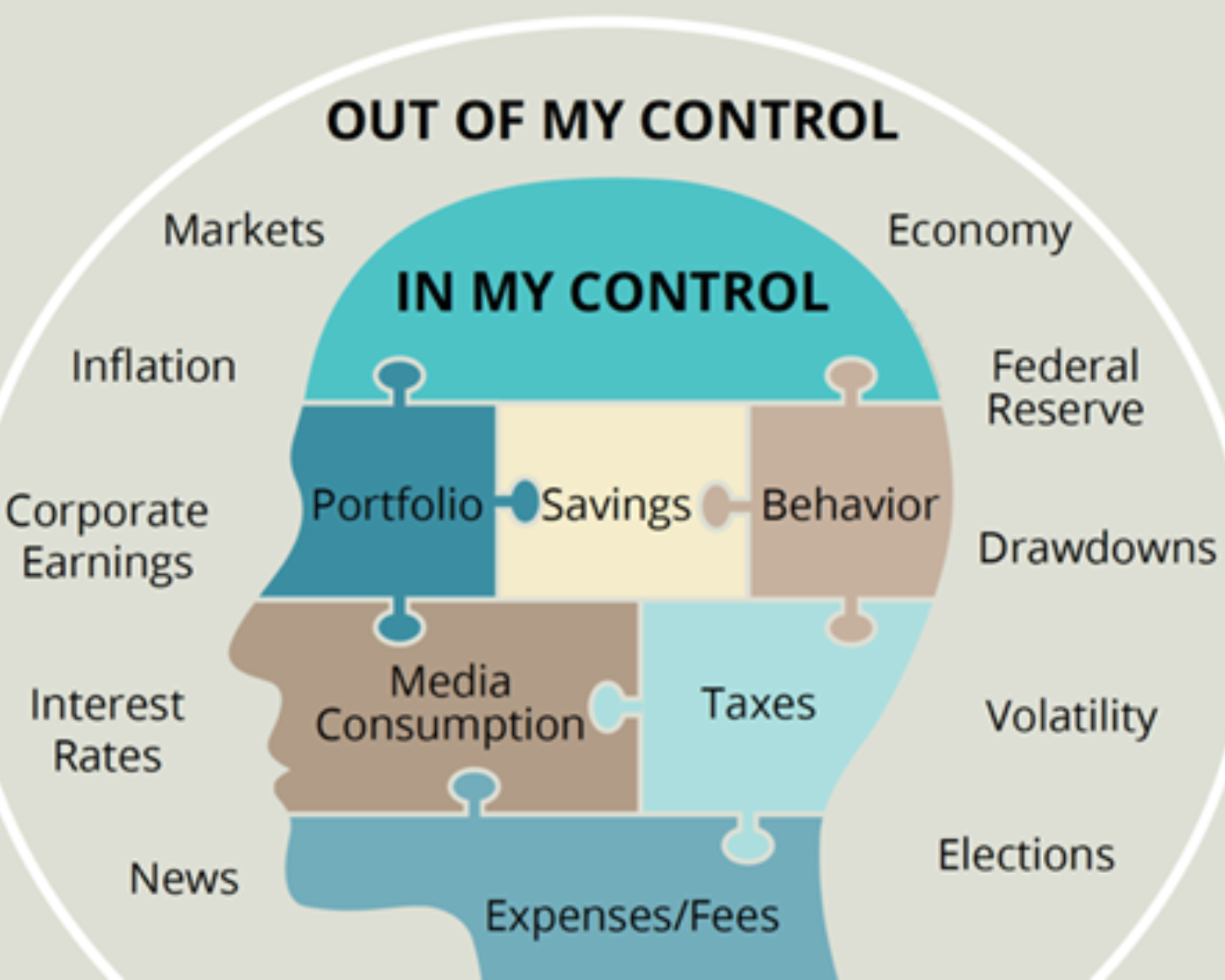

Factors such as market conditions, inflation, and personal circumstances can impact your optimal withdrawal rate. During periods of market volatility, for instance, reducing withdrawals can help preserve your portfolio. Conversely, strong market performance may allow for higher withdrawals without jeopardizing your long-term financial security.

Tax-Efficient Withdrawal Sequencing

The order in which you draw from your accounts can significantly affect your tax liability and the longevity of your assets. Our Core Services include expert tax planning to ensure your withdrawals are optimized. A typical withdrawal sequence might look like this:

- Taxable Accounts: Drawing from these accounts first allows tax-deferred accounts to grow longer.

- Tax-Deferred Accounts: Using funds from traditional IRAs or 401(k)s once required minimum distributions (RMDs) begin at age 73 helps manage taxable income.

- Tax-Free Accounts: Finally, Roth IRAs and similar accounts can provide a tax-free buffer, particularly in years when taxable income might push you into a higher tax bracket.

Strategic sequencing like this minimizes taxes while maximizing the lifespan of your savings.

Comprehensive Support Through Our Core Services

At Mercer Partners Wealth Management, we integrate every aspect of your financial life into a cohesive strategy, connecting the dots to create a unified plan. Our seven Core Services include:

- Investment Management: Crafting strategies to optimize your portfolio.

- Retirement Planning: Defining goals and preserving assets.

- Tax Planning: Proactive, tax-efficient solutions.

- Estate & Legacy Planning: Coordinating with legal professionals to secure your legacy.

- Insurance Planning: Evaluating policies for adequate protection.

- Cash Flow Planning: Optimizing income and expenses.

- Value-Added Services: Providing additional financial strategies to support your goals.

Adapting to Changing Needs

Retirement is a journey, not a destination. As your needs evolve, regular reviews of your income strategy ensure it stays aligned with your goals—whether it’s stability, leaving a legacy, or simply enjoying life to the fullest.

At Mercer Partners Wealth Management, our expertise and personalized approach empower you to navigate life’s transitions with confidence. Your trust inspires us to deliver exceptional service and thoughtful advice every step of the way.

Thank you for allowing us to be part of your financial journey!

Don Faul, CFP